Kujira is a fascinating project that I’ve been following for some time, and I believe it holds substantial potential.

Originally launched as a protocol on the Terra blockchain, Kujira made a bold move to re-launch on its own layer-1 following Terra’s collapse.

By choosing the Cosmos SDK, Kujira benefits from interoperability with other projects in the Cosmos ecosystem, a significant advantage.

Kujira immediately captured my attention with its numerous positive attributes.

🟡Kujira Tech

One of the aspects that excites me most about Kujira is its solid technological foundation. By leveraging the Cosmos SDK, Kujira not only benefits from interoperability within the Cosmos ecosystem but also brings some key technical innovations to the table.

Kujira operates using a delegated Proof of Stake (dPoS) consensus mechanism, which enhances both its scalability and security. This structure allows the network to handle a high volume of transactions efficiently while maintaining decentralization. What really stands out to me is their use of CosmWasm smart contracts, which adds an extra layer of flexibility and programmability. These contracts enable developers to build more sophisticated applications with greater ease, allowing for future growth and expansion.

Their tech stack positions Kujira to easily integrate with other Cosmos-based projects, and I’ve seen how this strategic choice boosts the network’s long-term potential.

From performance optimization to strong security measures, Kujira has built a tech infrastructure that makes it not just another layer-1 but a highly capable one with room to grow.

🟡Battle-hardened team

Always like to see teams that went through hard shit and successfully turned things around.

Their ability to make decisive moves during uncertain times and successfully grow their own chain after Terra’s collapse is a testament to their strength.

🟡User Experience

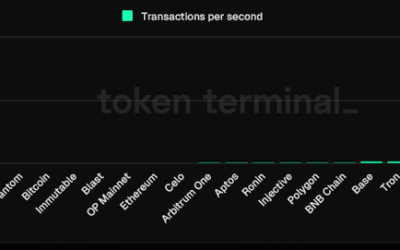

Kujira’s emphasis on user experience sets it apart. Many blockchains boast impressive metrics like TPS and BPS but neglect the user experience, leading to empty blockchains.

Kujira, however, focuses on creating an inclusive and fair trading environment with products like FIN and ORCA protocols, embodying their motto, « everyone can be a whale » (Kujira means whale in Japanese).

🟡Being Adopted

My experience in the crypto space has taught me to value projects being adopted.

I’m wary of early blockchains without a mainnet and prefer to avoid those with no signs of ecosystem growth.

In contrast, Kujira’s ecosystem is vibrant, with a TVL reaching up to $60 million according to Defilama, though the actual number might be higher.

The presence of high-quality protocols and community initiatives indicates active use and interest.

⭕️Let’s remain objective

While Kujira shows promising growth, it’s important to acknowledge that it hasn’t yet reached the adoption levels of giants like Solana or Ethereum.

Growth is evident in many areas, but some stagnation is inevitable, a common challenge for most crypto projects.

The project’s recent poor price performance has been a hurdle, but I believe it’s only a matter of time before it recovers.

Kujira appears to be a strong contender in the crypto space, and while predicting a top winner is challenging, I am confident it will perform well.

I’m excited to see how Kujira evolves and continues to capture interest in the crypto community.

UPDATE ON Kujira after $KUJI dumped

I’m mad at myself because I’m paying the price for not researching enough.

All the apparent fundamentals were good, but there was one big problem.

The Kujira core team put some of their KUJI as collateral to borrow against it.

They did that to bootstrap liquidity for the Kujira ecosystem.

While I can understand the reasoning (expanding initial liquidity is always a hard task), I can’t help but be critical of the execution.

1) Their liquidation price was very optimistic, too optimistic.

Anyone with some experience in altcoins knows that things can go wrong, and organic massive drawdowns are very common.

Being at risk with Kujira around a 100 million market cap seems crazy to me.

2) The Kujira team survived the Luna crash as they were initially part of the Terra ecosystem. They know better than anyone that crypto is a PVP and that other actors will try to exploit any perceived weak point.

The collapse of Luna was also provoked by an attack, targeting flaws or weak spots in the mechanism. It’s hard to accept that a team with such experience left the door open like this.

In any case, I’m sorry if one of my previous posts made anyone take a position in Kujira.

Regarding my position, I’m still holding it. There is no risk of unlimited minting of KUJI, so it’s not a situation like Luna.

I think Kujira will eventually recover from this mess. The infrastructure is there, the UX is top-notch, and the ecosystem is growing too.

If the price takes some time to recover, I will actually add more at some point.

The past few months have been hard. The $SPACE fiasco bled me out.

Every day, I’m questioning my portfolio: does it really make sense to bother with all these low caps?

I recently published a post reviewing some of the 2021 bull run winners.

The truth is that mid-to-high caps can perform insanely well too.

There is a high chance that Alephium, Aptos, Sei, Sui, Optimism, Tao, Ondo, Kaspa, Injective, etc. will outperform most of our shitcoins, no matter the cap.

And those projects are less likely to shit the bed in the process.

Crypto is a journey, and I’m definitely learning some costly lessons.

UPDATE 9 Sept 2024:

The Kujira x Thorchain Connection: Is KUJI on the Comeback Trail thanks to RUJIRA synergy? A few weeks back, I mentioned getting rekt on KUJI. Quick recap: the Kujira team overleveraged assets to fuel liquidity, but the market struck hard and things unraveled quickly. Now, though, the tides are turning. Kujira’s about to become a Layer-2 on Thorchain. And honestly, this has me bullish on KUJI once again.

Liquidity and Interoperability With this integration, Kujira taps into Thorchain’s cross-chain swaps and deep liquidity across major chains like Bitcoin, Ethereum, and Binance Chain—without needing wrapped assets. This move wipes out the liquidity constraints smaller DeFi platforms usually face. Now, Kujira can ride Thorchain’s liquidity engine, making transactions smoother and asset flow seamless.

This is the key to unlocking Kujira’s full potential. It makes its DeFi tools more valuable, and the expanded access to a wider range of assets will definitely pull more users into the ecosystem.

Growing the User Base This partnership doesn’t just bring liquidity; it opens up seamless user transfers between Thorchain and Kujira, boosting adoption for both. Scaling is everything in crypto, and this synergy positions Kujira to grow its user base and hit that next level of growth.

What’s Next? I’ll be digging into Thorchain’s numbers soon, but initial signs of adoption look positive, even if Thorchain still lags behind the heavyweights in daily transactions and addresses. That said, there’s massive growth potential for both Thorchain and Kujira, and I’m excited to see how this plays out.

What I really appreciate about Kujira is its fiercely loyal community and the number of community-driven apps already running. The ecosystem is solid—what it needs now is more adoption. With time, I think it’ll get there.