It’s been a while since I added APT to my watchlist. The launch generated significant buzz, but as the price dropped, the hype cooled off.

Despite this, Aptos has shown steady growth.

What really stands out is Aptos’ real adoption.

The ecosystem is thriving, with on-chain activity clearly on the rise.

Another major appeal is its « freshness ». Aptos hasn’t yet experienced a bull market or a euphoric phase.

I believe Aptos could emerge as a top winner in the next euphoric phase (if a bull run happens).

What’s Aptos?

Created by ex-Meta engineers, Aptos is a layer-1 blockchain that tackles key issues like scalability, security, and reliability with a fresh approach.

Its core technology, BlockSTM, processes multiple transactions simultaneously, boosting speed and efficiency.

The modular design allows for quick, easy updates.

Aptos also features the Move programming language, originally developed for Facebook’s Libra.

Move enables developers to build secure, flexible dApps and simplifies custom smart contracts.

Combined with a smart data model, it prevents resource loss and enhances transaction processing efficiency, boosting overall performance.

The network supports full nodes and light clients, allowing for varied participation.

Batching transactions reduces duplicate work and improves handling.

Validators share transaction batches constantly, boosting security and preventing attacks, keeping the blockchain resilient and reliable.

Scalability

Aptos boasts impressive scalability:

– Theoretical maximum TPS: 160,000

– Time to true finality: 0.9 seconds

Aptos Adoption is Real

On-chain analysis of Aptos reveals strong signs of adoption. Key metrics are trending upward across the board.

TVL

TVL is often the first metric I check when evaluating a layer-1 or layer-2 blockchain. It offers a quick glance at adoption levels. – Aptos TVL: $439 million – TVL Ranking: 18th overall – TVL Ranking for non-EVM chains: 6th Aptos is already a serious player, breaking into the top 20 TVL rankings despite launching its mainnet only in 2022. Two additional points: a) TVL has remained stable despite price fluctuations, a sign of strength.

This suggests more assets, whether APT or others, are circulating even during periods of low sentiment and higher risk aversion. b) The stablecoin market cap on Aptos has grown, reinforcing the notion of increased trust and adoption.

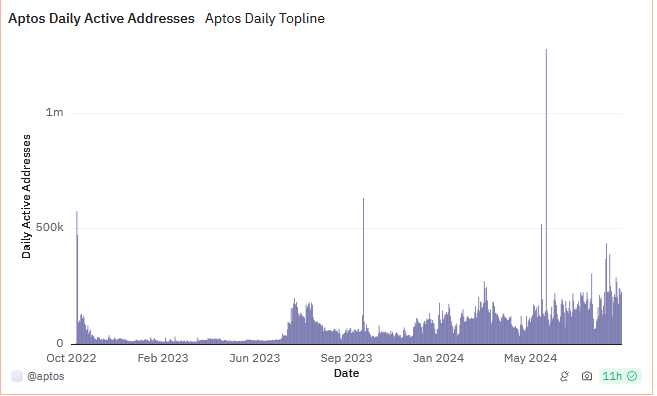

Daily Active Addresses

Aptos shows one of the most consistent growth patterns among layer-1 chains. Active user numbers have steadily increased month after month for over a year and a half. Recently, Aptos has consistently surpassed 200,000 daily active users.

To put that in perspective, Aptos ranks 13th across all blockchains (L1 and L2), which is an impressive achievement. User Transactions Aptos Explorer reports an average of 1 million user transactions per day. While transactions can be tricky to interpret—differentiating between “user” and “system” transactions varies by network—Aptos’ daily active user numbers support its high activity levels.

For more insight, we can examine the real transactions per second (TPS).

Aptos is among the top blockchains in terms of real TPS, averaging about 25 transactions per second. In the past 30 days, peaks have reached as high as 12,000 TPS.

My Take

I’m optimistic about Aptos as an investment. It’s a modern layer-1 that checks all the boxes for a potential significant run in the near future. An important point: Aptos has proven its scalability in real-world conditions. The network holds the record for the most transactions in a single day—nearly 100 million in May.

Over four days, Aptos processed 325 million transactions, sustaining over 2,000 TPS for more than 24 hours, with peaks reaching nearly 5,000 TPS. Gas fees averaged just 0.000001 APT.

With strong fundamentals, advanced technology, and growing adoption, there’s a solid case for Aptos regarding the next euphoric phase. I’m definitely bullish on it!