Arbitrum looks interesting!

Token was launched in 2023 and therefore never experienced a bull run yet. Mainnet was released before the token so the ecosystem had the time to build up.

Fundamentals look solid but it’s fair to say that not much hype is going on for Arbitrum at the moment.

One of the reasons to explain this apparent silence is the lack of traction of the L2 Ethereum narrative at the moment.

In my case, I still see Ethereum on the top in terms of TVL. With the recent ETF, I can also foresee Ethereum remaining relevant in the near future – which would put its ecosystem of Layers 2 in the front seat.

And amongst the L2 crowd, Arbitrum definitely stands out in many aspects.

What is Arbitrum?

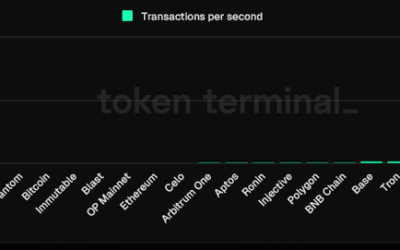

Some basic info (source:chainspect):

– Proof Of Stake

– Layer-2 Ethereum

– max.theorical TPS: 40’000

– Block time: 0.25 S

– 16 minutes finality

Arbitrum is a Layer 2 scaling solution for Ethereum, designed to make transactions faster and cheaper. It’s built on a technology called Optimistic Rollups, which essentially allows it to process transactions off the main Ethereum chain, then bundle them together and report back to the Ethereum blockchain.

This reduces congestion and significantly lowers gas fees, making it a game-changer for users and developers alike.

One of the biggest selling points of Arbitrum is its ability to drastically cut transaction costs. If you’ve used Ethereum during peak times, you know how high gas fees can get.

Arbitrum slashes those fees, making decentralized finance (DeFi) and other Ethereum-based applications much more accessible.

Plus, transactions are confirmed in just a few seconds, which is a huge improvement over Ethereum’s sometimes lengthy confirmation times.

Ecosystem

This is where Arbitrum makes a name for itself.

TVL rankings places arbitrum at the 5th spot on Defillama with a juicy TVL of 2 billion.

Cool thing about Arbitrum is that the chain is massively embedded into the global landscape of DeFi.

Major protocols such as AAVE, Uniswap, Curve, Pendle and notably GMX have already deployed on Arbitrum.

The chart shows a steady increase of TVL despite ARB price dropping, showing organic growth!

Another very positive sign of progress is the number of daily transactions. In the last month, 2 million transactions are performed on the network everyday on average!

To stimulate the ecosystem even more, Arbitrum Foundation has announced a $85 million Grant Program at the beginning of the year!

Arbitrum Orbit also needs to be mentioned:

Arbitrum Orbit is an initiative by the Arbitrum team that allows developers to create their own Layer 3 (L3) chains on top of the Arbitrum Layer 2 (L2) ecosystem. It’s essentially a framework for building customized blockchains that leverage the security and scalability of the Arbitrum network.

This would expand the ecosystem even more in the future!

Fundraising

Arbitrum raised up to $143 million between 3 funding rounds. Polychain Capital, Panthera Capital and Redpoint are amongst the investors.

Team

Offchain Labs is the team building Arbitrum.

Offchain Labs was founded in 2018 by Ed Felten, Steven Goldfeder, and Harry Kalodner.

Their mission with Offchain Labs is to scale Ethereum through Arbitrum blockchain.

Per Linkedin, the Offchain Labs team consists of at least 50 employees.

On-chain analysis of Arbitrum

Let’s dive into the on-chain metrics:

1/ TVL ranking

Arbitrum’s TVL is big. It sits at the 5th rank. It’s the biggest layer-2 Ethereum in terms of TVL. Arbitrum TVL is twice as big as the second biggest L2 TVL Base.

2/ Number of Apps/ Ecosystem size

Defillama registered 694 apps deployed on Arbitrum chain. Arbitrum is the 3rd chain in terms of app numbers. It’s a really impressive metrics given that its mainnet was launched only 3 years ago.

Beyond the number of apps, their inherent quality must be mentioned.

Arbitrum has obviously all the majors cross-chain protocols you could think of: Uniswap, AAVE, Curve, Beefy, Balancer but it’s also home to some big DeFi powerhouses such as Ondo, Balancer, GNS and the famous GMX.

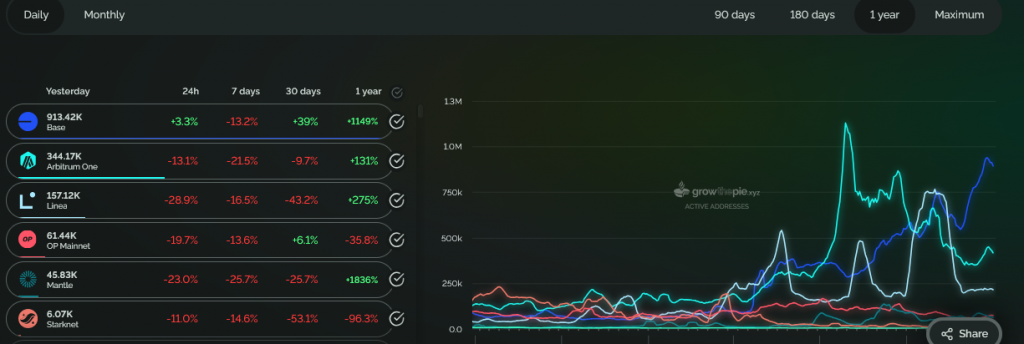

3/ Active addresses

In this metrics, Arbitrum ranks just behind BASE. Arbitrum has roughly 2 times less active adresses than BASE but it’s 2 times more active than Linea and almost 6 times than OP and Mantle.

So the level of activity remains very high in general, which totally makes sense given the size of Arbitrum ecosystem.

4/ Market Cap

Interestingly, Arbitrum market cap is similar to most other big layers-2. Yet, it’s doing better than most of them in all departments. (sometimes BASE is on top but it doesn’t have a native token yet).

When I put the arbitrum valuation against its on-chain metrics, I have the feeling that Arb is undervalued.

5/ Orbit Chains

The potential of growth for Arbitrum remains high thanks to its orbit chain features.

Arbitrum Orbit enables the permissionless launch of customizable chains using Arbitrum technology. These chains can operate as Layer 2 (L2) on Ethereum or Layer 3 (L3) on any Ethereum L2, like Arbitrum One.

Users have full control over chain components, including throughput, privacy, and governance, with options for decentralization.

6/ Token utility

One of the main criticism towards ARB is that the token utility is limited. Right now, ARB is only a governance token. ETH is used to pay fees when interacting with Arbitrum chain.

I’m not necessarily sensible to this argument: paying fees is a “fake utility”. Fees should always be as low as possible, so even if the demand is very high, the revenues generated are/must be low since the fees are low in value.

This won’t generate any sufficient demand in any case.

Summary

I do feel bullish on Arbitrum – I started to buy ARB a few days ago and will certainly keep adding. I foresee a real Ethereum season at some point that will benefit the strongest layers-2, including Arbitrum.

My rationale lays in 3 points:

– Massive TVL

– Real Growth

– Fresh coin that has never experienced a bull run yet

– Potential strong narrative (Layer-2 Ethereum)