🔴 $SEI / @SeiNetwork

Been scouring for projects with strong fundamentals and a clear path to adoption.

I found Sei Network and it lit up green lights everywhere!

This modern Layer-1 blockchain has a shot at being a top contender in the next market boom.

Sei has everything going for it: tech, team, community, infrastructure—all rock-solid.

Adoption is picking up steam daily, especially after the exciting V2 Upgrade in early 2024, which made Sei fully EVM-compatible.

>Sei Tech 🔴

- -TPS: 12500

-Finality: 0.38 sec

Sei Network is a next-gen Layer-1 blockchain made for trading apps. It offers lightning-fast transactions and efficient order matching.

Its decentralized Central Limit Order Book (CLOB) is a game-changer, ensuring high throughput and low-latency trading, perfect for DeFi and real-time applications.

In Q2 2024, Sei V2 Upgrade took things to the next level. It uses advanced tech like optimistic parallelization to improve transaction efficiency and introduces Ethereum Virtual Machine (EVM) compatibility.

This means Ethereum-based apps can now run seamlessly on Sei.

This mix of Ethereum’s flexibility and Sei’s high-performance makes it a hot spot for DeFi projects.

Sei V2 also combines EVM and CosmWasm, making it easy for developers to build and interact with different systems.

This powerful setup is set to attract many developers and projects to the Sei ecosystem.

>Current State of the Sei Ecosystem 🔴

When it comes to adoption, things are shaking up in Sei.

SEI’s Total Value Locked (TVL) has been surging, especially since the V2 upgrade was deployed.

Global TVL is now around $65 million, showing a substantial increase in less than a year and highlighting rapid adoption!

Sei currently holds the 45th spot on DefiLlama in terms of TVL ranking.

Notable Native Projects on Sei Network:

– Yei Finance: Lending

– DragonSwap: DEX

– Jellyverse: DEX

– Pallet Exchange: NFT Marketplace

– Yaka Finance: DEX

In November 2023, the Sei Accelerator Program was launched to support entrepreneurs and funders on Sei Network.

It will definitely help builders coming to the chain!

>Funding 🔴

Sei Labs raised up to $85 million.

Investors include: Circle Ventures, Bitget, Foresight Ventures, Jump Crypto, Distributed Global, Multicoin Capital, Coinbase Ventures and GSR Ventures.

>Sei co-founders & team 🔴

Jeff Feng graduated from UC Berkeley with a B.S. in Business Administration.

His career started with cryptocurrency mining and included roles at Goldman Sachs and VC firm CO2.

In 2022, he co-founded Sei with Jayendra Jog. Feng focuses on facilitating digital asset exchanges and sees potential in using AI in Web3 networks to incentivize data labeling through token ownership.

Dan Edlebeck has a decade of experience in business development and marketing. He previously founded Deedle Connects and led Cosmos-based projects Exidio and Sentinel. Dan holds an MBA from Babson College.

Jayendra Jog graduated from UCLA and has worked at Facebook, SAP, Pinterest, and Robinhood. His experience at Robinhood inspired the creation of a decentralized version of Robinhood.

The SEI team (Sei Labs) includes members from Uber, Airbnb, Goldman Sachs, and Coinbase, focusing on high-performance DeFi infrastructure.

>Where to buy SEI?

The token $SEI is pretty accessible. You will be able to find it on most popular exchanges such as Bybit, Binance, Gate, Coinbase or MEXC.

Good news, the token is also pretty liquid so you won’t be bothered much by price impact!

>Conclusion 🔴

SEI looks good and seems to be improving fast. I have started to build a position on it and will likely keep doing it overtime!

Feels like a chain with lots of upside potential. I will be monitoring adoption numbers but it’s fair to say SEI is definitely on the right

Image

track!

UPDATE :SEI LESS, STUDY MORE

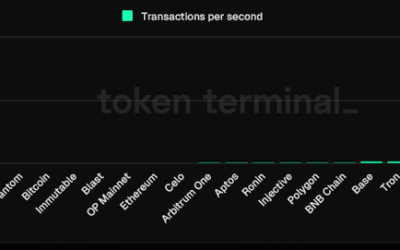

TLDR: Sei growth rate is outpacing Aptos, Sui and Ton. 🤯

When I hype Sei on Discord or Telegram, people often hit me with, « Sei’s numbers aren’t impressive, » especially compared to competitors like Sui, Ton, and Aptos.

But here’s the real story: SEI IS GROWING FASTER THAN MOST L1. 👇

I

Sure, Sei’s numbers might not be as high (in terms of numbers) as its competitors, but the growth trend is undeniable..

Check out the chart—Sei’s TVL (Total Value Locked) has been steadily climbing while Sui, Aptos, and Ton either stagnate or decline.

Let’s dive into SEI metrics!

🔴Daily Active Addresses:

This is a key metric. How many wallets (one wallet = one person, for simplicity) are interacting with the chain daily?

Sei has around 9,000 active wallets lately, with about half being “returning wallets.” But more than the number, it’s the trend that matters.

From May to mid-July, Sei averaged around 2,000 active wallets a day. Fast forward 10 weeks, and that number has quadrupled, with some serious spikes in activity.

Important note: These numbers don’t include smart contract addresses, meaning we’re focused on real users and real transactions, not automated bots.

🔴Transaction Count

After a spike in May ’24, Sei’s transaction volume has been gradually ticking upward.

The 30-day moving average shows steady growth, with the latest figures hovering around 120,000 transactions.

There’s room for more, and Sei is poised to excel once global on-chain activity picks up again.

🔴Active Contracts

Another strong indicator of growth is the number of active smart contracts. It’s one thing to deploy a contract—it’s another to see it being used.

The rise in active contracts mirrors the increase in new applications being launched on the Sei network.

🔴TVL

As I mentioned earlier, Sei’s TVL is on fire, growing faster than some of its top competitors.

Above all, I like the TVL vs SEI price difference. It’s showing real growth.

This could be the most bullish case for Sei right now.

Outside of Alephium, no other Layer-1 is seeing this kind of traction. The growth over the last month has been incredible.

TVL now consists of $116 million and ranks #37th on Defillama.

🔴Apps

Applications are the backbone of any ecosystem, and while Sei is still in its early stages, the basics are coming together.

We’re seeing strong progress from dapps like Jellyverse @jlyvrs

and Yei Finance @YeiFinance

, both showing impressive TVL growth on Defillama.

🔴Summary

All of Sei’s metrics are heading up.

Users, transactions, apps, and TVL are all showing consistent growth.

The most bullish sign? Sei’s TVL keeps rising, even during a market downturn (which also negatively impacts SEI token price)..

Once the market recovers, Sei could explode even harder!