« SUI, AN OBVIOUS WINNER FOR THIS BULL RUN »

I’ve managed to grab some SUI, though not as much as I’d like!

Just two days ago, Grayscale launched a Sui Fund for its clients.

Is that surprising?

Not really. Sui is a unique powerhouse in its own right.

Sui is in a prime position: launched in 2023 (yet to experience a bull run), packed with impressive tech, and rapidly gaining adoption.

If you’re into the layer-1 scene, this project is definitely worth researching—the team behind it knows how to get things done.

🔷The Tech Behind Sui: More Than Just Hype

Sui Network is a cutting-edge Layer-1 blockchain, built in Rust, and set to transform the smart contract world.

It leverages Sui Move, a modified version of the Move programming language, to support secure and resilient smart contract development.

The network operates on a Delegated Proof-of-Stake (DPoS) consensus mechanism, which ensures security through the staking of its native token, SUI, by both validators and tokenholders who delegate tokens to existing validators.

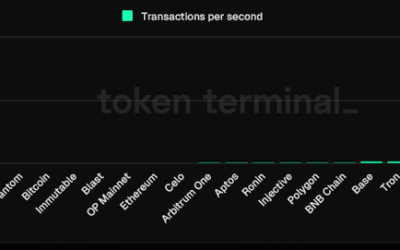

In terms of performance, Sui’s TPS (Transactions Per Second) output is impressive—reaching up to 100,000 TPS.

The network achieves time finality in about 0.48 seconds.

Unlike many blockchains, Sui has already demonstrated its scalability under real-world conditions.

During the « inscription » craze in December 2023, Sui handled peaks of up to 6,000 transactions per second without breaking a sweat.

Gas fees remained stable throughout, underscoring the network’s robustness in high-stress situations.

Sui truly feels fast. I experimented with Cetus (DEX), and every type of transaction—swapping, providing liquidity—was incredibly quick.

The same goes for using the native staking feature in Sui’s Mobile Wallet. The user experience is smooth and lightning-fast.

🔷Adoption and Ecosystem

Sui Network is buzzing:

– Averaging 8 million transactions per day

– Daily peak TPS hovering around 120

– About 400,000 active users every day

It’s clear that SUI is gaining serious traction.

The Total Value Locked (TVL) stands around $440 million, with stablecoins making up half of it. Key protocols include Navi, Cetus, Scallop, and Suilend.

You’ll find all the essential DeFi dApps you need to thrive: lending platforms, liquid staking, DEXs, NFT marketplaces, and more.

🔷Funding

Sui has raised approximately $336 million, with backing from a16z, Redpoint, Lightspeed Venture Partners, and Jump Crypto.

🔷Team

Sui was founded in 2021 by Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Chalkias.

Their journey began at Meta, where they worked on projects like Libra and Novi Finance.

When regulatory challenges halted these projects, the team pivoted, leading to the creation of two blockchains: Aptos and Sui.

Mysten Labs, formed to build on the research done for Diem, has been leading Sui’s development ever since.

🔷Summary

Sui stands out as a clear contender for this upcoming bull run.

I’ve already taken a small position at the bottom and plan to gradually increase my exposure to SUI over time.

With everything in place, it has the potential to be one of the top performers in the next market surge!

On-Chain Analysis of SUI: Don’t Fade The Tsunami

Sui is making waves lately. Ever since the Grayscale Sui Fund announcement, its price has been outperforming the market.

On-chain data shows real growth, and SUI has become one of my top Layer-1 picks for the next big market rally.

TVL is one of the most crucial on-chain metrics. If more value is staked on a network, it’s a strong signal that adoption is growing.

Here’s what stands out about SUI’s TVL:

1) SUI’s TVL now sits at $670 million, ranking 12th on Defillama. Among non-EVM chains, SUI is 3rd, just behind Solana and Hyperliquid.

Image

What’s impressive is that its TVL is already larger than Aptos, another Move-based Layer-1, and TON.

2) The price-to-TVL relationship is another strong point. Since April 12, 2024, SUI’s price has dropped while TVL has held steady or increased.

That’s a huge indicator of growth.

It shows that more value is flowing into the blockchain, not just staking of the SUI token. Right now, TVL is outpacing price, and that’s significant.

3) Stable mcap is $360 million according to Defillama, a huge numbers indicating a high-level of trust from investors.

🔵Daily Accounts

This metric really sets SUI apart.

1) There’s a clear uptrend in daily active addresses, with more users interacting with the SUI blockchain every day.

2) The numbers themselves are impressive: SUI is averaging 500K active accounts in recent months, dwarfing Aptos, which sits around 200K.

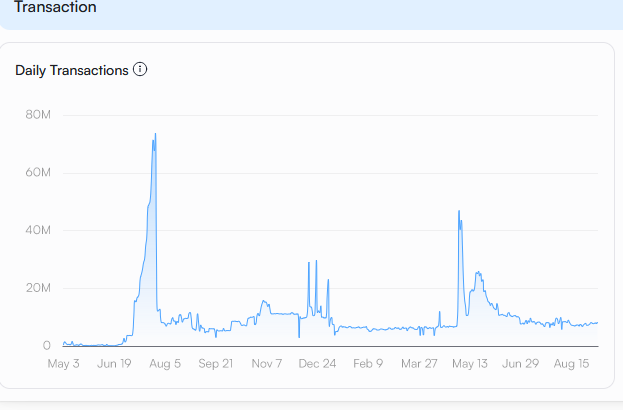

🔵Daily Transactions

The daily transactions chart is tricky because it seems to include “system transactions,” which can inflate activity numbers.

These are internal actions like block rewards or governance votes, not real user transactions.

Given the uptick in both TVL and daily active accounts, it’s safe to assume real transactions are climbing too.

🔵My Take

What’s remarkable is that SUI’s TVL and daily accounts have been growing while the market has been trending down since March ‘24.

Most projects have cooled off recently due to poor market sentiment, but Sui is growing despite the downturn.

That’s a massive sign of resilience!